why do tech stocks sell off when interest rates rise

Rising bond yields could keep a choke hold on tech and growth stocks for now as investors bet the Federal Reserve will raise interest rates four or more times this year. Large-cap technology stocks usually are market leaders when interest rates are rising.

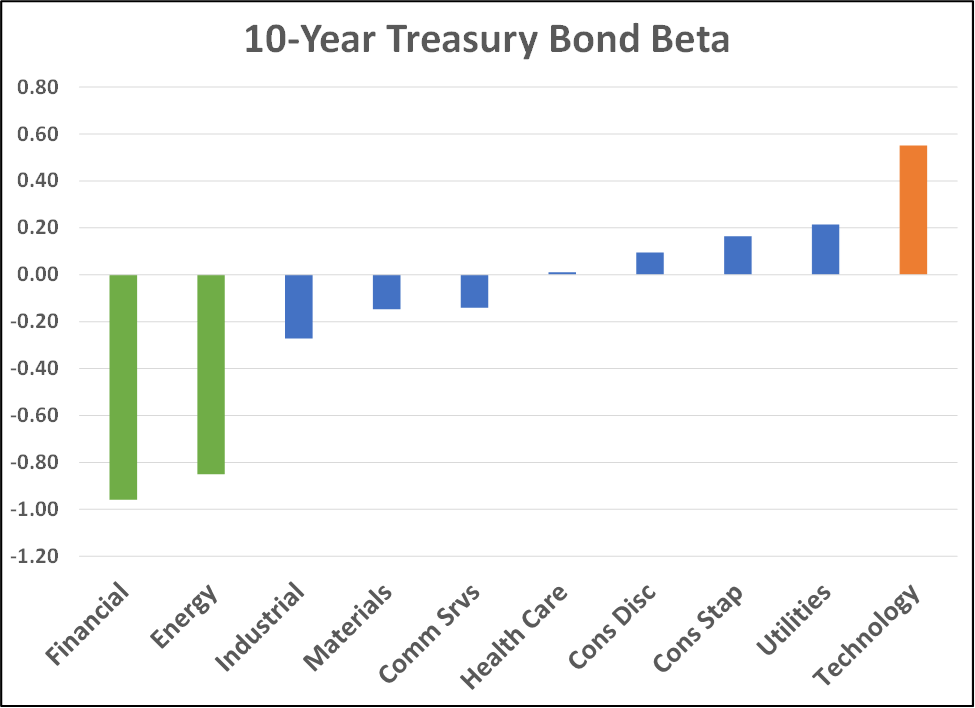

Rising Rates And Or Inflation Is Not A Friend Of Technology Stocks Knowledge Leaders Capital

Stocks tumbled Monday.

. Large-cap tech stocks could face increasing margin pressure amid macroeconomic trends such as deglobalization a weaker US. An estimated 58 of tech sector sales originate outside the US where. As interest rates rise the cost of borrowing becomes more expensive for them resulting in higher-yielding debt issuances.

Thats because the companies sell more software and equipment as consumers and businesses typically increase their tech spending in a growing economyand they earn higher interest rates on their massive cash reserves. By business reporter Michael Janda. Overall though rising interest.

Understand How Rising Interest Rates Relate to Corporate Earnings. After an initial heavy sell-off tech stocks pared their losses. Interest rates are rising and tech stocks are likely to head in the other direction.

However tech stocks are fundamental for healthy portfolio returns. The headline news is rising interest rates. When interest rates rise from 5 to 10 investors value the profits earned one year from now by the jayz company much less and are not.

Also Hammered as Interest Rates Rise. Why Higher Bond Yields Are Bad News for Tech Stocks Like Amazon and Zoom. Thats why Twilio TWLO-051 a high-growth cloud communications.

Government-bond yields is pressuring the stock market and forcing investors to more seriously confront the implications of rising interest rates. The direction of interest rates can impact overall market activity and the movements of stock prices. That interest rate is effectively the risk-free rate of return for any investment you want to make and as the interest rate on bonds rises bonds become more attractive and.

When the interest rate starts to rise the downward pressures for such stocks are extremely high. Large-cap technology stocks usually are market leaders when interest rates are rising. When a companys costs rise its profit margins can dip even if sales continue apace.

That is why it is not hard to see that stocks in the tech sectors such as Nasdaq 100 or Hang Seng Tech have been sold off lately. Dollar and scrutiny of low corporate tax rates. When interest rates are low.

Why do tech stocks sell off when interest rates rise january 25 2021. 2 days agoThese are seven of the best tech stocks to buy now amid the tech resurgence April 7 2022 By Louis Navellier and the InvestorPlace Research Staff Apr 7. The lift in.

2 days agoShares of artificial intelligence AI-powered lending platform Upstart NASDAQ. Stay on top of changing australian stock markets with our exclusive expert analyst reports 5 strong buy stocks under 10 to own for 2021. As well the stock market will start to re-value the stocks and downgrade the target prices.

The big selloff in the technology sector isnt simply a US. Tech Stocks Outside US. Stock price as of october 2.

Microsoft Apple and. Indeed theres a not-so-subtle rotation underway in the stock market this year. One way governments and businesses raise money is through the sale of bonds.

The Dow Jones Industrial Average eked out a slight gain rising 2737 or less than 01 to 3152169. While members of the NYSE FANG index including Tesla. You can skip our detailed analysis of the technology sector.

Why Do Tech Stocks Sell Off When Interest Rates Rise. Tech stocks that were recently trading at records posted broad declines. That is why it is not hard to see that stocks in the tech sectors such as nasdaq 100 or hang seng tech have been sold off lately.

The sharp increase this month in US. Fast-growing technology stocks have been slammed because of rising bond yields amid expectations for stronger economic growth. UPST fell 126 this week in another difficult period for fintech stocks.

Why Technology Stocks Plunged on Monday. Therefore unprofitable tech companies that are trading at frothy valuations usually suffer the most as interest rates rise. Thats because the companies sell more software and equipment as consumers and businesses typically increase their tech spending in a growing economyand they earn higher interest rates on their massive cash reserves.

Today stocks on the Nasdaq are trending lower on monetary policy concerns. 2022 has been much more friendly to. Its widely believed that Powell continuing to head the Federal Reserve means short-term interest rates will.

There wasnt any particular news out of. Conventional wisdom tells us that we should avoid tech stocks in an increasing interest rate scenario.

Everyone Thinks Rising Interest Rates Are Bad For Tech Stocks But Are They Institutional Investor

The Best And Worst Sectors For Rising Interest Rates Seeking Alpha

What Happens To The Stock Market When Interest Rates Rise

Nasdaq Mixed Friday Market Nasdaq The Stock Market Was Mixed On Friday As The Dow Was Down 9 Basis Points The S P 500 Nasdaq Direct Marketing Stock Market

Weekend Reads How To Invest Amid Higher Inflation And As Interest Rates Rise Marketwatch In 2022 Investing Weekend Reading Interest Rates

2 Sell Off Stocks That Could Help Set You Up For Life The Motley Fool In 2022 Accounting Images The Motley Fool Stanley Black And Decker

Rising Interest Rates Could Keep A Choke Hold On Tech And Growth Stocks

Investors Should Brace For A Frightening Recession Tech Stocks Stock Advice Buy Stocks

Stock Markets Off To Worst Start Since 2016 As Fed Fights Inflation The New York Times

Everyone Thinks Rising Interest Rates Are Bad For Tech Stocks But Are They Institutional Investor

4 Stocks For When Real Interest Rates Are Rising Barron S In 2022 Interest Rates Value Stocks Rate

Will The Stock Market Go Up Or Crash In 2022 What Top Forecast Models Predict Fortune

Charting The Global Economy War Driving Inflation Growth Risks In 2022 Global Economy Market Risk Economy

Brookfield Asset Management Bam Stock Price News Info The Motley Fool

Bond Yields Jump Stock Futures Rise After Powell Says Fed Is Ready To Be More Aggressive In 2022 Global Stocks Stock Futures Government Bonds

/dotdash_Final_Blow-Off_Top_Dec_2020-01-79b7b9ca1aaa41a98d75d06aa76d947f.jpg)